Filters

Tax

-

Save 25%

Original price Rs. 695.00Current price Rs. 520.00

Save 25%

Original price Rs. 695.00Current price Rs. 520.00Understanding the Provisions of Clubbing of Income (Under the Income Tax Law)

Author: Ram Dutt Sharma Year: 2024 This book is an easy guide to understand the Clubbing provisions to guide the everyone about some important thin...

View full detailsOriginal price Rs. 695.00Current price Rs. 520.00Save 25% -

Save 25%

Original price Rs. 695.00Current price Rs. 520.00

Save 25%

Original price Rs. 695.00Current price Rs. 520.00Income Tax Refunds (Law & Procedure) Under The Income Tax Law

Year: 2024 Author: Ram Dutt Sharma In this book, the author has given a conspectus of circumstances under which refunds arise under the various pro...

View full detailsOriginal price Rs. 695.00Current price Rs. 520.00Save 25% -

Save 25%

Original price Rs. 695.00Current price Rs. 520.00

Save 25%

Original price Rs. 695.00Current price Rs. 520.00Understanding the Special provisions of Presumptive Taxation Scheme For Resident & Non-Resident (Under the Income Tax Law)

Year: 2024 Author: Ram Dutt Sharma As amended by the Finance Act 2024 This book is an attempt to make aware about the provisions of the Income-tax ...

View full detailsOriginal price Rs. 695.00Current price Rs. 520.00Save 25% -

Save 20%

Original price Rs. 1,695.00Current price Rs. 1,356.00

Save 20%

Original price Rs. 1,695.00Current price Rs. 1,356.00Standards On Auditing A Practitioner's Guide

Author: CA. Kamal Garg Year: 2024 Division I * Statutory Auditors’ Practice Pointer References to Engagement and Quality Control Standards * List o...

View full detailsOriginal price Rs. 1,695.00Current price Rs. 1,356.00Save 20% -

Save 20%

Original price Rs. 1,350.00Current price Rs. 1,080.00

Save 20%

Original price Rs. 1,350.00Current price Rs. 1,080.00Charitable Trust | Law and Procedure – A Ready Reckoner

Year: 2024 Author: Chambers of Tax Consultants This comprehensive offers a nuanced analysis of charitable trusts, featuring 15+ incisive and in-dep...

View full detailsOriginal price Rs. 1,350.00Current price Rs. 1,080.00Save 20% -

Save 20%

Original price Rs. 2,095.00Current price Rs. 1,676.00

Save 20%

Original price Rs. 2,095.00Current price Rs. 1,676.00GST Acts with Rules/Forms & Notifications

Year: 2024 This book covers amended, updated & annotated text of the CGST/IGST/UTGST Acts & GST (Compensation to States) Act, along with GS...

View full detailsOriginal price Rs. 2,095.00Current price Rs. 1,676.00Save 20% -

Save 20%

Original price Rs. 400.00Current price Rs. 320.00

Save 20%

Original price Rs. 400.00Current price Rs. 320.00GST Appellate Mechanism | Key Aspects and Procedures

Year: 2024 Author: KSCAA, K.S. Naveen Kumar, Annapurna Kabra This comprehensive guide discusses the procedural and substantive aspects of GST appel...

View full detailsOriginal price Rs. 400.00Current price Rs. 320.00Save 20% -

Save 20%

Original price Rs. 400.00Current price Rs. 320.00

Save 20%

Original price Rs. 400.00Current price Rs. 320.00GST Law Simplified with Relevant Case Laws

Year: CA Srikantha Rao T and KSCAA Year: 2024 This book is a comprehensive guide to simplifying GST laws, offering clarity through case law analysi...

View full detailsOriginal price Rs. 400.00Current price Rs. 320.00Save 20% -

Save 20%

Original price Rs. 375.00Current price Rs. 300.00

Save 20%

Original price Rs. 375.00Current price Rs. 300.00NFRA Audit Quality

Year: 2023 Author: KSCAA This book offers an in-depth exploration of auditing standards in India, particularly highlighting the role of the Nationa...

View full detailsOriginal price Rs. 375.00Current price Rs. 300.00Save 20% -

Save 20%

Original price Rs. 3,795.00Current price Rs. 3,040.00

Save 20%

Original price Rs. 3,795.00Current price Rs. 3,040.00Yearly Tax Digest & Referencer 2024

Year: 2024 Yearly Tax Digest – 'YTD' is a comprehensive annual publication from Taxmann's Editorial Board that offers a detailed section-wise diges...

View full detailsOriginal price Rs. 3,795.00Current price Rs. 3,040.00Save 20% -

Save 25%

Original price Rs. 7,550.00Current price Rs. 5,665.00

Save 25%

Original price Rs. 7,550.00Current price Rs. 5,665.00GST Law and Commentary in 4 vols.

Year: 2024 Author: Bimal Jain With Analysis and Procedures Tags: #gst

Original price Rs. 7,550.00Current price Rs. 5,665.00Save 25% -

Save 20%

Original price Rs. 2,295.00Current price Rs. 1,836.00

Save 20%

Original price Rs. 2,295.00Current price Rs. 1,836.00Direct Taxes Law & Practice with Special Reference to Tax Planning

Year: 2024 Author: Vinod K. Singhania, Kapil Singhania This book has been the 'go-to-guide' for Students & Professional Practitioners for over ...

View full detailsOriginal price Rs. 2,295.00Current price Rs. 1,836.00Save 20% -

Save 20%

Original price Rs. 345.00Current price Rs. 276.00

Save 20%

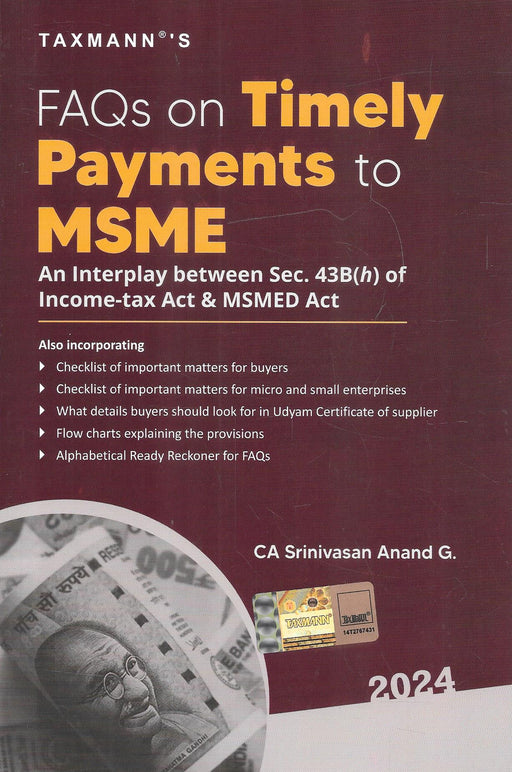

Original price Rs. 345.00Current price Rs. 276.00FAQs on Timely Payments to MSME – An Interplay between Sec. 43B(h) of the Income-tax Act & MSMED Act

Author: Srinivasan Anand G. Year: 2024 This book is a comprehensive guide to ensuring timely payments to Micro, Small, and Medium Enterprises (MSME...

View full detailsOriginal price Rs. 345.00Current price Rs. 276.00Save 20% -

Save 20%

Original price Rs. 2,195.00Current price Rs. 1,760.00

Save 20%

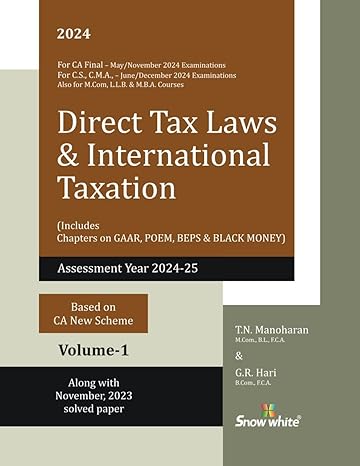

Original price Rs. 2,195.00Current price Rs. 1,760.00TN Manoharan - Direct Tax Laws and International Taxation

Year: 2024 CA Final May/November AY 2024-25 Tags: #manoharan #direct #tax #international #taxation #9788119637133

Original price Rs. 2,195.00Current price Rs. 1,760.00Save 20% -

Save 20%

Original price Rs. 6,695.00Current price Rs. 5,356.00

Save 20%

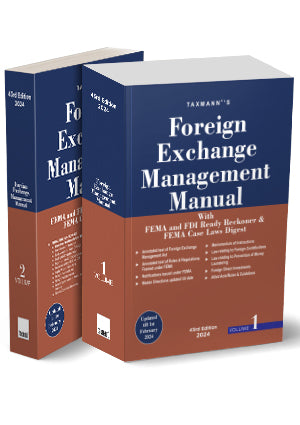

Original price Rs. 6,695.00Current price Rs. 5,356.00Foreign Exchange Management Manual with FEMA and FDI Ready Reckoner & FEMA Case Laws Digest | Set of 2 Volumes

Year: 2024 The Foreign Exchange Management Manual with FEMA and FDI Ready Reckoner & FEMA Case Laws Digest is a comprehensive guide on India's ...

View full detailsOriginal price Rs. 6,695.00Current price Rs. 5,356.00Save 20% -

Save 30%

Original price Rs. 4,450.00Current price Rs. 3,115.00

Save 30%

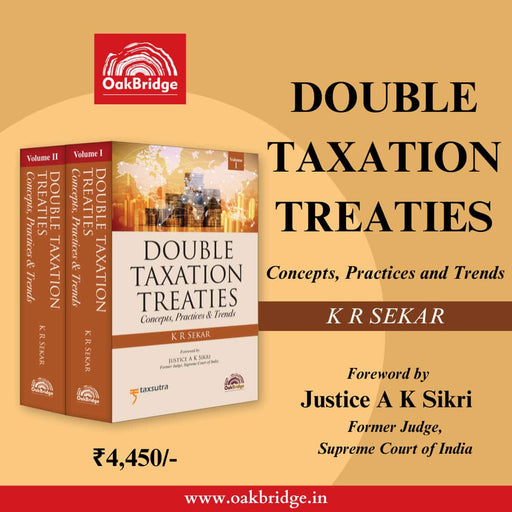

Original price Rs. 4,450.00Current price Rs. 3,115.00Double Taxation Treaties - Concepts, Practices and Trends

Year: 2024 Author: K R Sekar Tentative dispatch date: 7th Feb 2024 This book is a comprehensive exploration of Double Taxation Avoidance Agreements...

View full detailsOriginal price Rs. 4,450.00Current price Rs. 3,115.00Save 30% -

Save 20%

Original price Rs. 2,995.00Current price Rs. 2,396.00

Save 20%

Original price Rs. 2,995.00Current price Rs. 2,396.00Law & Practice Relating To UAE Corporate Tax

Author: Nirav Shah Year: 2024 This book aims to analyse and elucidate the intricacies of tax laws and their practical applications strictly within ...

View full detailsOriginal price Rs. 2,995.00Current price Rs. 2,396.00Save 20% -

Save 30%

Original price Rs. 2,995.00Current price Rs. 2,096.50

Save 30%

Original price Rs. 2,995.00Current price Rs. 2,096.50Sampath Iyengar's Law of Income Tax (13th Edition), 2024 Volumes 8

Year: 2024 Volume 8 covers Sections 116 to 146 Expected Date of Release and Dispatch 10 Feb 2024 Sampath Iyengar’s Law of Income Tax has maintained...

View full detailsOriginal price Rs. 2,995.00Current price Rs. 2,096.50Save 30% -

Save 20%

Original price Rs. 1,050.00Current price Rs. 840.00

Save 20%

Original price Rs. 1,050.00Current price Rs. 840.00How to Deal with GST Show Cause Notices with Pleadings

Year: 2024 Author: A Jatin Christopher This book blends practicality with legal expertise and offers a comprehensive guide on handling GST Show Cau...

View full detailsOriginal price Rs. 1,050.00Current price Rs. 840.00Save 20% -

Save 30%

Original price Rs. 20,970.00Current price Rs. 14,680.00

Save 30%

Original price Rs. 20,970.00Current price Rs. 14,680.00Chaturvedi and Pithisaria’s - Income Tax Law - Volume 6 to 11

Year: 2023 This Set is in 11 vols Vol 6 (Sections 60 to 86A)Vol 7 (Sections 87 to 109)Vol 8 (Sections 110 to 139)Vol 9 (Sections 139A to 171)Vol 10...

View full detailsOriginal price Rs. 20,970.00Current price Rs. 14,680.00Save 30% -

Save 20%

Original price Rs. 11,875.00Current price Rs. 9,500.00

Save 20%

Original price Rs. 11,875.00Current price Rs. 9,500.00The Effect of Directives Within the Area of Direct Taxation on the Interpretation and Application of Tax Treaties

Author: Mees Vergowen Year: 2023 The Effect of Directives Within the Area of Direct Taxation on the Interpretation and Application of Tax Treaties ...

View full detailsOriginal price Rs. 11,875.00Current price Rs. 9,500.00Save 20% -

Save 25%

Original price Rs. 6,495.00Current price Rs. 4,870.00

Save 25%

Original price Rs. 6,495.00Current price Rs. 4,870.00How to Handle Income Tax Problems in 2 vols AY 2024-2025

Author: Narayan Jain and Dilip Loyalka Year: 2024 Tags: #978819819607 #incometax #tax #problems

Original price Rs. 6,495.00Current price Rs. 4,870.00Save 25% -

Save 30%

Original price Rs. 17,475.00Current price Rs. 12,232.50

Save 30%

Original price Rs. 17,475.00Current price Rs. 12,232.50Chaturvedi and Pithisaria’s - Income Tax Law - Volume 1 to 5

Year: 2023 This Set is in 11 vols Volumes 1 to 5 will be released in December 2023*Volumes 6 to 11 will be released in Jan 2024* Vol 1: Sec 1 to 9(...

View full detailsOriginal price Rs. 17,475.00Current price Rs. 12,232.50Save 30% -

Save 20%

Original price Rs. 4,325.00Current price Rs. 3,460.00

Save 20%

Original price Rs. 4,325.00Current price Rs. 3,460.00Transfer Pricing and Business Restructurings Current Developments, Relevant Issues and Possible Solutions

Year: 2023 Transfer pricing and business restructurings: issues and developments In the ever-evolving global landscape, the ability of businesses t...

View full detailsOriginal price Rs. 4,325.00Current price Rs. 3,460.00Save 20% -

Save 20%

Original price Rs. 4,325.00Current price Rs. 3,460.00

Save 20%

Original price Rs. 4,325.00Current price Rs. 3,460.00Transfer Pricing and Financial Transactions - Current Developments, Relevant Issues and Possible Solutions

Year: 2022 Since years, issues related to transfer pricing and intra-group financing are prominent in the agendas of both taxpayers and governments...

View full detailsOriginal price Rs. 4,325.00Current price Rs. 3,460.00Save 20% -

Save 20%

Original price Rs. 6,110.00Current price Rs. 4,885.00

Save 20%

Original price Rs. 6,110.00Current price Rs. 4,885.00Attribution of Profits to Permanent Establishments

Year: 2020 The profit attribution to permanent establishments is one of the most controversial topics in international tax law. In recent years it ...

View full detailsOriginal price Rs. 6,110.00Current price Rs. 4,885.00Save 20% -

Save 20%

Original price Rs. 8,930.00Current price Rs. 7,145.00

Save 20%

Original price Rs. 8,930.00Current price Rs. 7,145.00Multilateral Cooperation in Tax Law

Series on International Tax Law, Volume 135 Year: 2023 An in-depth analysis of various aspects of multilateral cooperation in tax law Tax evasion a...

View full detailsOriginal price Rs. 8,930.00Current price Rs. 7,145.00Save 20% -

Save 20%

Original price Rs. 695.00Current price Rs. 555.00

Save 20%

Original price Rs. 695.00Current price Rs. 555.00Trust & NGOs – Your Queries on Audit Reports (Form Nos. 10B & 10BB) & Income-tax Return (ITR-7)

Author: Manoj Fogla, Suresh Kumar Kejriwal, Tarun Kumar Madaan Year: Oct 2023 The detailed contents of the book are as follows: FAQs on Audit of T...

View full detailsOriginal price Rs. 695.00Current price Rs. 555.00Save 20% -

Save 30%

Original price Rs. 2,995.00Current price Rs. 2,096.50

Save 30%

Original price Rs. 2,995.00Current price Rs. 2,096.50Sampath Iyengar's Law of Income Tax (13th Edition), 2023 Volumes 7

Year: 2023 Revised by H. Padamchand Khincha and Chythanya K.K. Year: Sept 2023 Covering Sections 90 to 115WM Sampath Iyengar’s Law of Income Tax...

View full detailsOriginal price Rs. 2,995.00Current price Rs. 2,096.50Save 30% -

Save 30%

Original price Rs. 5,999.00Current price Rs. 4,199.00

Save 30%

Original price Rs. 5,999.00Current price Rs. 4,199.00A Compendium Of Issues On Income Tax (In 2 Volume)

Author: Dr. Girish Ahuja and Dr. Ravi Gupta Year: 2023

Original price Rs. 5,999.00Current price Rs. 4,199.00Save 30% -

Save 20%

Original price Rs. 995.00Current price Rs. 796.00

Save 20%

Original price Rs. 995.00Current price Rs. 796.00The Income Tax Act, 1961 (Bare-Act) Pocket For AIBE Exams

Year: 2023 Tags: #aibe #allindiabar

Original price Rs. 995.00Current price Rs. 796.00Save 20% -

Save 20%

Original price Rs. 1,495.00Current price Rs. 1,196.00

Save 20%

Original price Rs. 1,495.00Current price Rs. 1,196.00GST Scrutiny , Assessment , Adjudication , Demand & Recovery

Year: 2023 Author: CA. (Dr.) Sanjive Agarwal , CA. (Dr.) Neha Somani Chapter 1 GST in India — An Overview ...

View full detailsOriginal price Rs. 1,495.00Current price Rs. 1,196.00Save 20% -

Save 30%

Original price Rs. 23,953.00Current price Rs. 16,765.00

Save 30%

Original price Rs. 23,953.00Current price Rs. 16,765.00Permanent Establishment in Cross Border Transactions

Year: 2010 Author: Ekkehart Reimer, Marianna Katharina Roth , Nathalie Urban Permanent Establishments. A Domestic Taxation, Bilateral Tax Treaty an...

View full detailsOriginal price Rs. 23,953.00Current price Rs. 16,765.00Save 30% -

Save 20%

Original price Rs. 1,145.00Current price Rs. 916.00

Save 20%

Original price Rs. 1,145.00Current price Rs. 916.00Audit Saar Handwritten Notes Advanced Auditing & Professional Ethics - CA Final

Year: 2023 applicable for Nov. 2023 Author: CA. Khushboo Girish Sanghavi

Original price Rs. 1,145.00Current price Rs. 916.00Save 20% -

Save 20%

Original price Rs. 695.00Current price Rs. 556.00

Save 20%

Original price Rs. 695.00Current price Rs. 556.00Audit Ke Saval Advanced Auditing And Professional Ethics

Year: 2024 Author: CA Khushboo Girish Sanghvi Applicable for May 2024 tags: #ca #final #examination

Original price Rs. 695.00Current price Rs. 556.00Save 20% -

Save 20%

Original price Rs. 1,197.00Current price Rs. 957.60

Save 20%

Original price Rs. 1,197.00Current price Rs. 957.60Auditing & Ethics

Year: 2023 Author: CA G. Sekar Applicable For May 2024 Examination And Onwards Including Relevant Standards On Auditing

Original price Rs. 1,197.00Current price Rs. 957.60Save 20% -

Save 20%

Original price Rs. 999.00Current price Rs. 799.20

Save 20%

Original price Rs. 999.00Current price Rs. 799.20Corporate & Other Law - CA Inter New Syllabus

Year: 2023 Author: CA. G. Sekar Applicable For May 2024 Examination And Onwards

Original price Rs. 999.00Current price Rs. 799.20Save 20% -

Save 20%

Original price Rs. 435.00Current price Rs. 348.00

Save 20%

Original price Rs. 435.00Current price Rs. 348.00Advanced Auditing And Professional Ethics MCQ's Book - CA Final

Year: 2024 Author; CA Khushboo Girish Sanghavi Applicable for May 2024 eaxms tags: #ca #final #examination

Original price Rs. 435.00Current price Rs. 348.00Save 20% -

Save 20%

Original price Rs. 747.00Current price Rs. 597.00

Save 20%

Original price Rs. 747.00Current price Rs. 597.00CA Foundation - Basics of Accounting

Year: 2023 Author: Paduka Applicable for Nov 2023 exams and Onwards

Original price Rs. 747.00Current price Rs. 597.00Save 20% -

Save 20%

Original price Rs. 597.00Current price Rs. 477.60

Save 20%

Original price Rs. 597.00Current price Rs. 477.60CA Foundation - Business Economics & Business And Commercial Knowledge

Year: May 2023 Author: CA. G. Sekar , CA. B. Saravana Prasath Applicable For Nov. 2023 Examination & Onwards

Original price Rs. 597.00Current price Rs. 477.60Save 20% -

Save 20%

Original price Rs. 2,795.00Current price Rs. 2,239.00

Save 20%

Original price Rs. 2,795.00Current price Rs. 2,239.00IND AS Ready Reckoner

Year: July 2023 Author: Parveen Sharma Salient Features Deals with complex standards in a simplified and lucid manner. The approach of the book is...

View full detailsOriginal price Rs. 2,795.00Current price Rs. 2,239.00Save 20% -

Save 30%

Original price Rs. 695.00Current price Rs. 487.00

Save 30%

Original price Rs. 695.00Current price Rs. 487.00PMLA - Handbook for Reporting Entities

Year: 2023 Author: Kamal Garg Tags: #ca #pmla #reportingentities #entities #reporting #moneylaundering

Original price Rs. 695.00Current price Rs. 487.00Save 30% -

Save 20%

Original price Rs. 1,595.00Current price Rs. 1,276.00

Save 20%

Original price Rs. 1,595.00Current price Rs. 1,276.00Student's Handbook Taxation

Author: T. N. Manoharan Year: 2024 AY 2024-25 (Includes Income-Tax Law Good And Services Tax Law) for B.Com & CA Intermediate Course - May 2024...

View full detailsOriginal price Rs. 1,595.00Current price Rs. 1,276.00Save 20% -

Save 20%

Original price Rs. 1,195.00Current price Rs. 956.00

Save 20%

Original price Rs. 1,195.00Current price Rs. 956.00Ready Referncer On Accounting For CA Inter

Author: CA. G. Sekar , CA. B. Saravana Prasath Year: May 2023 Applicable for November 2023 examination and onwards

Original price Rs. 1,195.00Current price Rs. 956.00Save 20% -

Save 20%

Original price Rs. 1,995.00Current price Rs. 1,596.00

Save 20%

Original price Rs. 1,995.00Current price Rs. 1,596.00Law Relating to Reassessment

Author: D.C. Agrawal, Ajay Kumar Agrawal Year: 2023 The book is a treatise on 'Reassessment under Income Tax Act' containing each aspect of the law...

View full detailsOriginal price Rs. 1,995.00Current price Rs. 1,596.00Save 20% -

Save 20%

Original price Rs. 1,595.00Current price Rs. 1,276.00

Save 20%

Original price Rs. 1,595.00Current price Rs. 1,276.00MSME Ready Reckoner

Year: 2023 The MSME Ready Reckoner is a comprehensive reference book for understanding Indian MSME laws, offering insights into MSMEs' classificati...

View full detailsOriginal price Rs. 1,595.00Current price Rs. 1,276.00Save 20% -

Save 20%

Original price Rs. 1,195.00Current price Rs. 956.00

Save 20%

Original price Rs. 1,195.00Current price Rs. 956.00Qualifications & Other Comments In The Auditor's Report

Author: CA. Kamal Garg Year: 2023 Division 1Introduction to Audit Report Principles under SAsChapter 1Auditing — Nature and Basic ConceptsChapter 2...

View full detailsOriginal price Rs. 1,195.00Current price Rs. 956.00Save 20% -

Save 20%

Original price Rs. 1,695.00Current price Rs. 1,356.00

Save 20%

Original price Rs. 1,695.00Current price Rs. 1,356.00Handbook On Internal Auditing

Author: CA. Kamal Garg Year: 2023 Chapter 1 Auditing — Nature and Basic Concepts Chapter 2 Internal Audit under Companies Act, 2013 C...

View full detailsOriginal price Rs. 1,695.00Current price Rs. 1,356.00Save 20%